-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Critical Illness and Disability Insurance – Competition or Valuable Coexistence? [Part 2 of 3]

8. August 2023

Ronald Schwärzler

English

Deutsch

As an international reinsurer, we see in many markets that only one of the two products is successfully established. In Asia, Disability insurance plays a very minor role compared to Critical Illness (CI) insurance in terms of premium volume. In Western Europe, on the other hand, the picture of premium volume is reversed. Disability insurance is widely sold there, while CI insurance is unknown to a large part of the population. In contrast, both products appear to be relatively well known in the Anglo-Saxon countries, although there are usually considerable differences in the premium volumes.

So, there seems to be a competition between the two insurance products. This may be since both products serve to close a financial gap caused by an accident or an illness. For example, both instruments can be used by insured persons to continue to pay a loan even though they are no longer able to generate income. As a result, after taking out CI or Disability insurance, the insured persons’ willingness to take out the other insurance product may decrease, as in their view another, apparently similar policy is not necessary.

Better protection by combining both products

The potential offered by a combination of the two insurance products for insureds seems to be untapped so far. The two products can be designed in such a way that they complement each other in a meaningful way and provide excellent cover for insured persons: disability insurance generally covers the loss of income due to accident or illness on a pro-rata basis, while CI insurance covers the financial requirements following an accident or an illness.

If insured persons have taken out Disability insurance, an additional CI insurance policy offers them the option of covering special costs. With the lump-sum payment made in the event of a claim, for example, insured persons could arrange for a particularly cost-intensive treatment that they have to pay for themselves or finance the conversion of their home if mobility is restricted in the long term due to the insured event.

Conversely, it may make sense to supplement existing CI insurance with Disability insurance. For example, the lump-sum payment can be used to cover special costs and the long-term financial consequences of an insured event can be cushioned with a pension benefit of a Disability insurance.

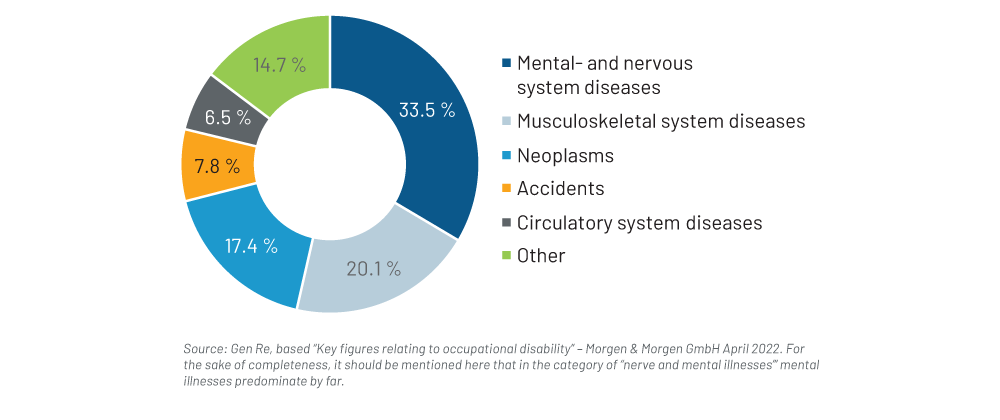

The different purposes of the types of cover are made clear by looking at the products’ benefit triggers. For example, musculoskeletal and mental illnesses are very rarely covered by CI insurance, although it has been proven that they can lead to financial distress for those affected. In the case of Disability insurance, however, these diseases now account for the lion’s share of claims, as illustrated by the example of German occupational disability insurance in the figure below. Cancer, myocardial infarction and stroke, which together typically account for 80%–90% of claims in CI insurance, rank only in third place (tumours) and in fifth place (heart and vascular diseases) among the causes of disability.

Causes of Occupational Disability

In terms of severity, completely different approaches are often taken. While Disability insurance policies often aim to measure the extent of the inability to work, medical criteria for illness are used as the basis for assessment in CI insurance policies.

Another criterion that illustrates the difference between the two products is the time it takes for insureds to receive a benefit. With Disability insurance, deferred periods of six months are not unusual. Insureds must therefore wait six months after the onset of the illness before receiving an insurance benefit. In contrast, CI insurance with an accelerated death benefit is usually paid immediately after a covered illness has been diagnosed.

By combining both insurance concepts in one product, rapid financial support for diagnosis can be ensured, followed by long-term income protection in the event of disability due to accident or illness. Of course, an extremely short deferred period can be chosen in a Disability insurance policy. However, as explained in the first part of this blog series, this is accompanied by a significant increase in premiums.

The “other product” as an alternative

In addition, it is often the case that for many insureds, comprehensive Disability insurance may be (too) expensive or even impossible from the outset. One reason for this may be the pursuit of a profession that is considered dangerous. The figures in the table below are based on data from the 2013 IDI Valuation Table of the American Academy of Actuaries, where occupations are divided into four groups according to their risk. Occupations in the highest risk category are assessed as having almost two-and-a-half times the risk compared to occupations in the lowest risk category.

CI insurance, on the other hand, is usually offered without classification into occupational groups, as the occupational group usually has too little influence on the probability of illness to make classification worthwhile.

|

Occupational Class (OC) |

Description |

Example |

Probability of disability1 |

In % of OC A |

|---|---|---|---|---|

|

A |

Graduates, senior managers, no manual work, very low risk |

Actuary |

3.6 ‰ |

100% |

|

B |

Office personnel, qualified technicians, salespeople, no other hazardous activities |

Accountant |

5.3 ‰ |

145% |

|

C |

Qualified craftspeople |

Carpenter |

6.6 ‰ |

183% |

|

D |

Hard physical work, high-risk occupations |

Bricklayer |

8.1 ‰ |

223% |

In addition to a risky occupational group, pre-existing conditions of insured persons may prevent them taking out disability insurance, particularly if it is linked to “occupational diseases” (e.g., a previous herniated disc among craftspeople). If there is a relevant pre-existing condition, premiums are often subject to a premium loading to reflect the higher risk of a claim. The latter may result in the insurance being too expensive for potential insured persons, causing them to refuse to take out the insurance.

Depending on the type and severity of the pre-existing condition, an insurer might not insure such a risk at all, which means that it is impossible to take out Disability insurance from the outset.

These cases illustrate that alternative or supplementary insurance can be extremely important. In rare cases, Disability insurance may be an alternative to CI insurance. By contrast, CI insurance is used much more frequently as an alternative to Disability insurance. One reason for this is often pre-existing illnesses that are closely linked to the most common beneficiaries of Disability insurance, which means that Disability insurance is usually too expensive for the potential insureds.

In summary, the two products are more different than they are similar, which suggests that the two products co‑exist on the insurance market rather than in a competitive situation. A combination of both products can be a sensible approach to obtaining the best possible cover for insureds.

In our next blog, the last in this series, we will share ideas that link Critical Illness and Disability products as a way to complement the insurance offerings in a valuable way.

Endnote

- “2013 IDI Valuation Table” from the American Academy of Actuaries. The incidence rates refer to individual business, unisex (50:50 women:men), age 40, 90‑day deferred period, pension up to age 65, smoking-non-smoking aggregate for all causes of accidents and illness.