-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Group Term Life and AD&D Survey Reveals Overall Gains for U.S. Carriers

18. September 2023

Mike Fullerton

Region: North America

English

Gen Re recently released the results of our 2022 U.S. Group Term Life Market Survey. A valuable benchmarking resource for participants, the longstanding annual survey covers the Group Term Life (GTL) and Accidental Death and Dismemberment (AD&D) industry, tracking sales and in-force results among other data. Twenty-seven companies participated in the survey this year. Although a positive picture overall, the analysis shows a mixed experience for some participants. Here’s a quick overview of the results.

Sales Results

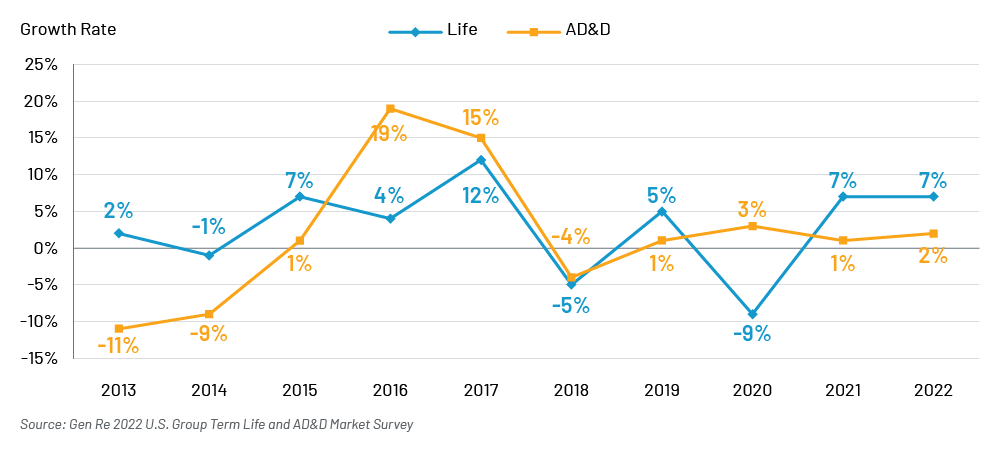

Group Term Life (GTL) new sales premium continues to show strong growth increasing by 7% for the second consecutive year after a large decline in 2020. Participating companies reported over $3.2 billion in combined GTL and AD&D sales premium in 2022, with GTL accounting for 92% of the total.

The top 10 companies held 84% of the market share for new sales premium, contributing around $2.5B of total 2022 sales.

AD&D sales premium growth had a slight increase of 2%. Combined GTL and AD&D sales premium posted a 7% increase compared with 2021.

Group Term Life Growth

GTL new sales case counts were flat year-over-year. Only one third of companies (10 out of 27) reporting this data experienced a positive result. Seven companies reported a decrease greater than 10%. In-force case counts were up by 2% in 2022.

For companies providing sales case size breakdown information for the two-year period, the 10–99 category accounted for the highest percentage of cases in 2022 (55%), followed by the 1–9 grouping (28%). Results were similar for in-force (51% and 30%, respectively).

After seeing moderate growth in 2021, new sales lives decreased by 5% in 2022. In-force lives grew by 4% year-over-year. The decline in new sales lives was due to four companies with reported decreases greater than 30%.

GTL and AD&D In-force Results

On a combined basis, total GTL and AD&D in-force premium reached $32.8 billion, with GTL representing the majority (94%) of the total.

GTL in-force premium growth remained positive in 2022. After reaching a 10-year peak in 2021, GTL growth rates slowed from 6% to 4%. The top 10 companies all reported positive GTL in-force premium growth in 2022.

AD&D in-force premium recovered after experiencing a five-year market low in 2020: in 2022, premium rose by 5%.

On a combined basis, GTL and AD&D in-force premium increased by 4% year-over-year.

Group Term Life Pricing and Volume Levels

Average face amounts for new sales grew 11% in 2022. In-force face amounts continue to average at over $100,000. Monthly premium rates were up by 6% for new sales and remained flat for in-force.

New sales face amounts averaged below $100,000 for the first time since 2019.

It’s worth noting that a small number of companies strongly influenced the average new sales premium per life result. Removing just two companies would result in a 5% increase vs. a 13% increase year-over-year.

You can read the summary report with more charts from the Gen Re Research Center – and if you have any questions about the findings, please reach out to me.