-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Financial Analysis – Challenging Times for Many U.S. Mutual Insurers

29. April 2024

Tim Fletcher,

William Wilt (President of Assured Research) (guest contributor)

Region: North America

English

During 2023, severe convective storms (SCS) and extreme rain events wreaked havoc and significantly impacted the Mutual carriers that form the backbone of the insurance industry. As we enter the Spring of 2024, similar squalls seem to be gathering on the horizon.

In this piece, our friends at Assured Research detail which U.S. regions were hardest hit by hail, tornadoes, and wind events in 2023, examining the correlation between these events and the financial results of Mutual insurers in those regions. In addition, they share insights as to how the current year might prove to be even more devastating than the last due to record-high temperatures in the Atlantic and strong atmospheric jet streams.

Assured Research was kind enough to allow us to reprint this article in its entirety. We hope you find it as compelling as we did.

Poor weather is the main culprit; an inflection point for reinsurers if the weather returns to normal.

To prepare for this article, we’ve married year-end 2023 financial data for Mutual insurers writing (predominantly) in each of the four regions of the country with weather data from NOAA. Our objective is to better understand: 1) just how anomalous recent hail, tornado, and strong wind patterns have been by region, and 2) to examine the correlation between the weather events and the financial results of the Mutuals writing predominantly in each region.

A word on our definitions

We’re using S&P Global’s definition that identifies a company with a region when 50% of more of its direct premiums come from one specific region. Regional definitions follow the U.S. Census Bureau. National companies are those not drawing >50% of DWP from one specific region.

We’re focusing on Mutual insurers because of the extra underwriting attention and higher reinsurance prices that greeted many of them at the January 1, 2024 reinsurance renewals – particularly those writing predominantly in the Midwest.

Notably, our financial results are shown net of reinsurance, so we’d expect in 2024 that volatile weather (and it is forecasted to be volatile) could have an even greater impact on the primary insurers’ net results.

Our Takeaways

Most of the story is told in subsequent graphs, but here are the highlights:

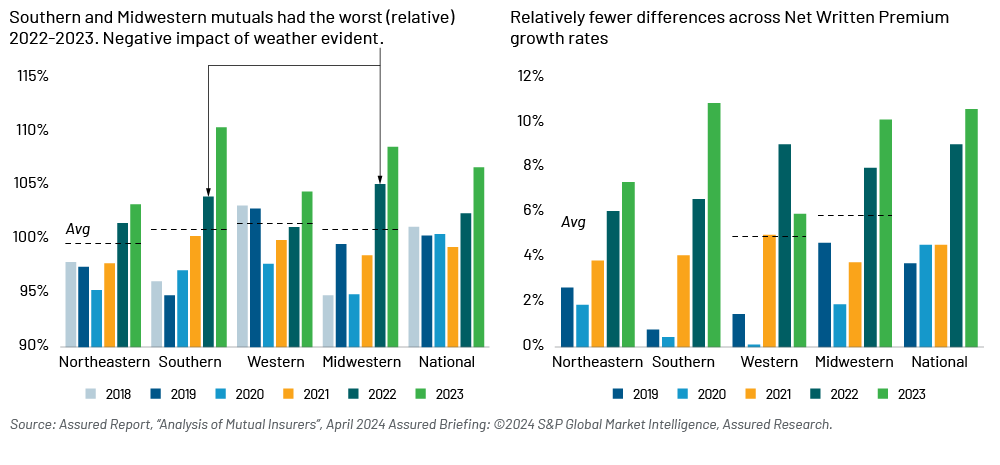

- Mutual companies writing in the South and Midwest showed the highest combined ratios in 2022 and 2023 as well as the sharpest deterioration from the years immediately prior.

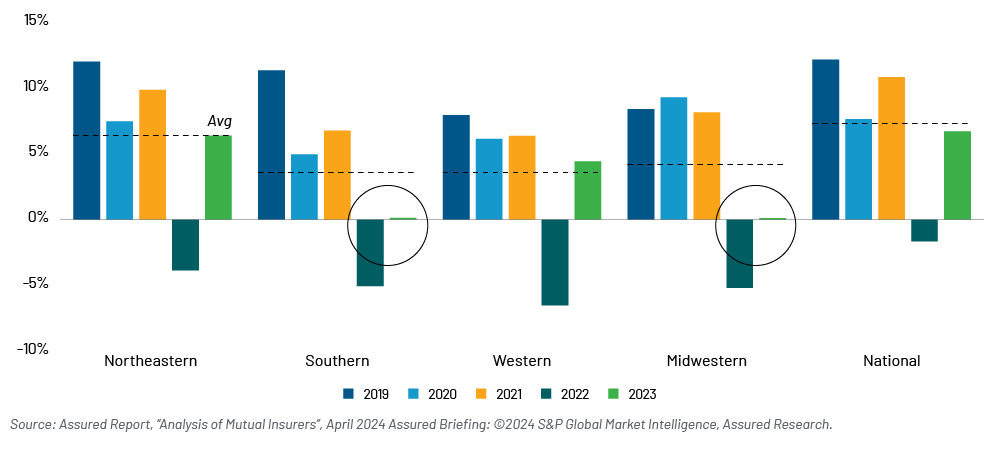

- Southern and Midwestern Mutuals produced the lowest surplus generation in 2022 and 2023.

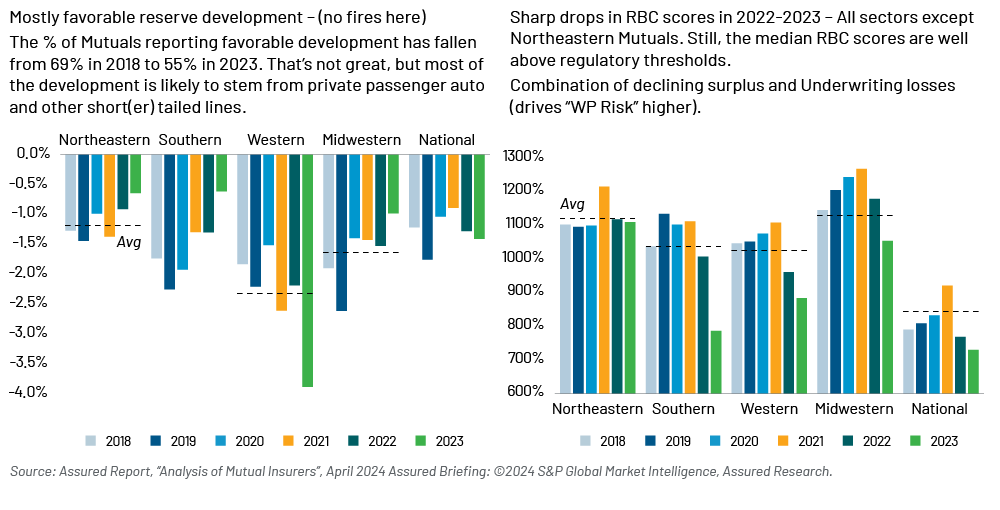

- RBC ratios fell broadly, but the sharpest decline was across Southern and Midwestern Mutuals. Still, it bears noting that Mutual insurers, on balance, sport RBC ratios well in excess of regulatory thresholds.

- The level of favorable reserve development is lessening, as across the industry, but financial challenges appear to stem primarily from weather.

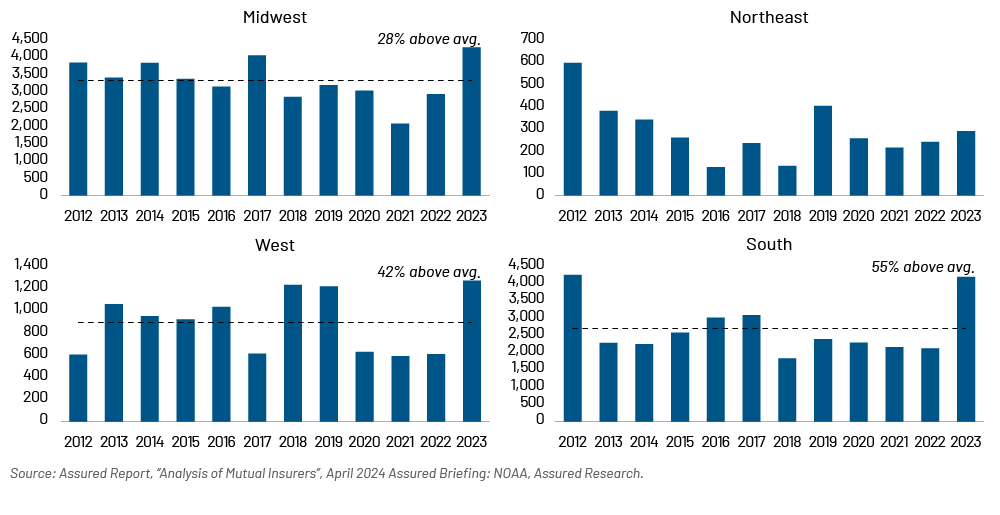

- Data from NOAA reveals that loss-causing hail events spiked everywhere in 2023 except the NE.

- Tornadoes and strong wind events were more variable…the issue in 2023 was largely hail.

What of 2024, you ask? Grab a box of tissues and read through to the end of this article we include an outlook for severe convective storms and hurricanes.

Financial Analysis of Mutual Insurers by Region

Combined Ratio and Premium Growth – Southern / Midwestern Mutuals

Change in Surplus: 2019‑2023 – Southern / Midwestern Mutuals

Mutual companies in Southern and Midwestern states have experienced the lowest levels of surplus generation over the past two years, hence the sharpest drops in their Risk Based Capital scores (See next figure). Business opportunities here for competitors and for reinsurers to find ameliorative solutions to protect balance sheets (and income statements).

Reserve Development (% Surplus) and RBC Scores

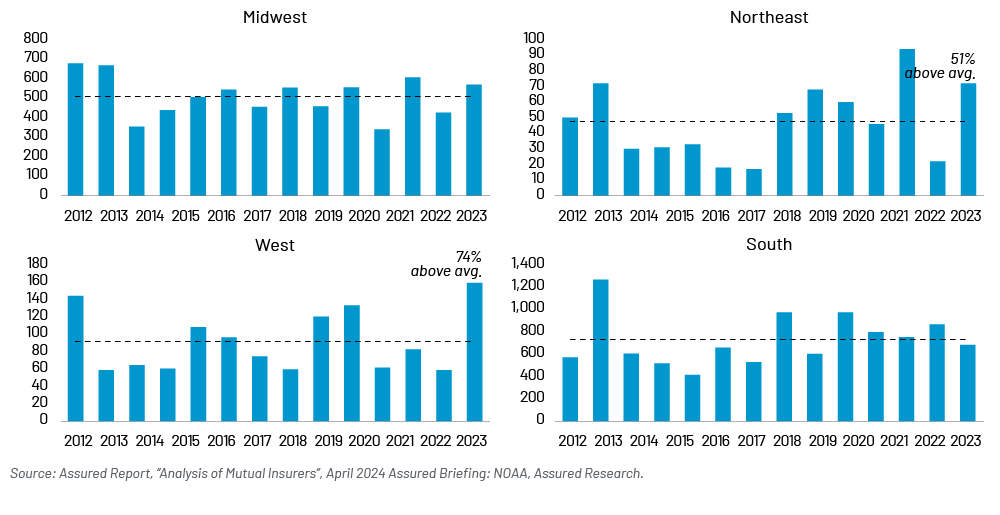

Hail Events (>1”) by Region 2012‑2023

Hail events with large stones were well above average everywhere expect in the Northeast. NOAA made changes to the way hailstone sizes were reported around 2010. We recommend starting hail series (parsing on size) in ~2012 or later.

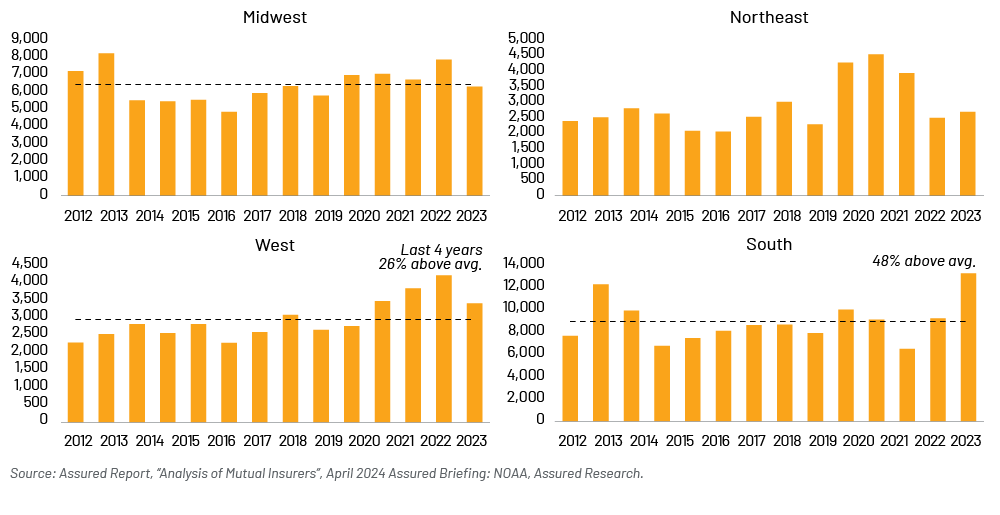

Tornadoes by Region 2010‑2023

The Midwest and South saw unusual hail activity but broadly normal tornado frequency. The West experienced both more frequent tornadoes and hail. Forecasters are expecting an active tornado and hurricane season.

Wind and Thunderstorm Wind Events by Region 2010‑2023

The South experienced strong and thunderstorm winds commensurate with their above average hail events; other regions less so (though the trend in the West is notable). We’re not certain how much or how frequently these winds result in insured losses, but the data is readily available, so we included it.

Weather Forecast: Bad…and Wet

We’re grateful to Weather Trends International (WTI) for sharing this year-ahead forecast for 2024. Interested readers are invited to reach out directly or contact us for an introduction. Here is a short video to learn more.

Severe Convective Storms

Last year WTI forecast the worst tornado/hail season in 4 years and this year is even more extreme. The reason is due to another rapidly evolving climate cycle going from a strong El Nino to a moderate to strong La Nina by Summer combined with an overall very negative Pacific Decadal Oscillation Cycle (PDO) and a near record warm Atlantic Multidecadal Oscillation (AMO) Cycle among a dozen other factors. The sun is also entering its solar maximum which creates a warm and very moist global atmosphere. This on top of the 146 million tons of water vapor that was sent 63,000 feet into the atmosphere with the Tonga January 2022 volcanic eruption. That volcanic water vapor is stuck in the atmosphere for 5‑10 years so the overall theme for 2024 is a warm and very wet atmospheric pattern combined with a strong Polar and Subtropical Jet Stream energy as the ingredients needed for widespread severe weather.

Tornadoes

Tornadoes (specifically) are again likely to be well above average and the most since 2020 and 2011. While hail was a big issue for the insurance industry last year, this year may have more tornadic-type storms than hailstorms due to warmer/wetter weather (hail more common with a cooler and drier atmosphere).

Hurricanes

The biggest threat this year will be 22+ named tropical systems with exceptionally high risk for at least a couple major hurricanes in Texas. A secondary threat area would be extreme south Florida (Miami – Key West), not North Florida, with a third area from North Carolina to Virginia. Combined with near record hot Atlantic Ocean temperatures in the main tropical development area, it’s a very high-risk season.

Summary

If it is indeed another active season for hail, tornadoes, and hurricanes that will pressure Mutual insurers even more than last year since most, we gather, will have less reinsurance protection than in 2023. Reinsurers have generally moved away from I/S protection (i.e., retroactive reinsurance) and toward B/S (i.e., prospective reinsurance) protection by attaching at events with 1/10 (or greater) likelihood.

But while Mutuals have taken a few punches in recent years, they don’t seem to us to be on the ropes. Auto insurance results should be steadily improving (and Auto is less capital intensive so can be retained), favorable reserve development has weakened but not disappeared, and Risk Based Capital ratios are broadly strong. Still, this spring seems like the right time for reinsurers and reinsurance brokers to visit with their Mutual counterparts in person – not virtually.

About the Guest Contributor

William Wilt is President at Assured Research, LLC. He has a substantial and wide-ranging background in numerous facets of insurance research, operations, finance, consulting, and the capital markets, as well as analytical expertise from a credit and equity perspective as well as substantial securities and corporate valuation experience. Gen Re is appreciative of his knowledge-sharing with our clients.

Assured Research is a research and advisory firm dedicated to delivering differentiated and actionable research and analysis to insurance professionals. Assured Research marries rich industry experience, extensive industry relationships, and independence to deliver unique insights.