-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Florida’s Tort Reform Revolution – Following a Year of Change in the Sunshine State

25. März 2024

Michael Pagenta,

Christina Roberto (Partner of Tittmann Weix) (guest contributor)

Region: North America

English

This week marks the one-year anniversary of Florida House Bill 837 (“HB 837”). HB 837 made significant changes to Florida law concerning personal injury litigation and insurance claims. This article provides a year-in-review on the state of personal injury and bad faith law in Florida in the wake of tort reform.

Efforts to Avoid HB 837

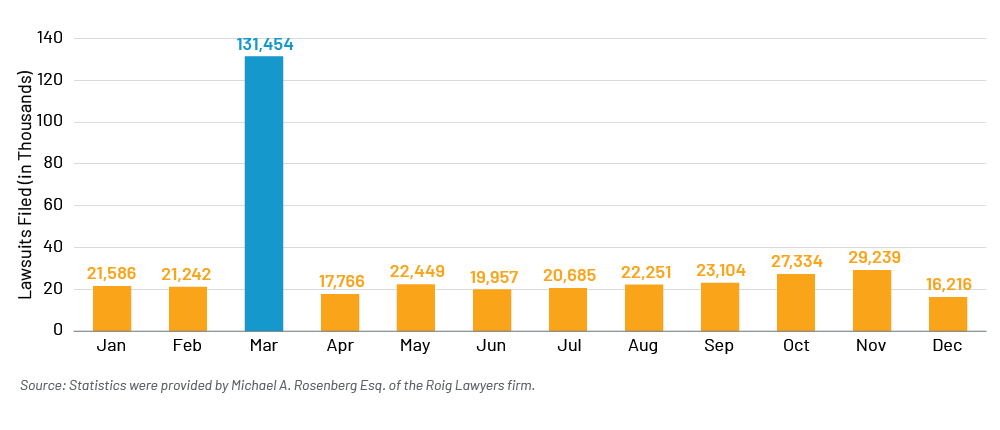

HB 837 took effect on March 24, 2023. While the legislation was pending and prior to its effective date, the plaintiffs’ bar went to great lengths to avoid application of the new laws to existing cases. More than 70,000 lawsuits were filed in Florida from March 18 to March 23, 2023, alone.1 To put this massive wave of filings in perspective, the number of motor vehicle lawsuits filed in Florida in March 2023 was more than six times higher than the number of similar lawsuits filed in any other month that year.2

Florida Motor Vehicle Lawsuits Filed 2023

One plaintiffs’ law firm alone reportedly will have filed 25,000 lawsuits in the weeks before the law took effect.3 Many expressed concerns that this flood of lawsuits would clog the courts, overburden the defense bar, and delay the handling of insurance claims relating to these suits.4

Impact of HB 837 on Florida Bad Faith Law

Although there have not been any substantive decisions interpreting or applying the provisions of HB 837 yet, it is clear the provisions of HB 837 will have a profound impact on Florida bad faith law in the years to come.

HB 837 makes clear that mere negligence in the handling of a policy limits demand is insufficient to establish bad faith. This is a much-needed clarification of Florida bad faith jurisprudence, as the line between bad faith and negligence was blurred in the wake of the Florida Supreme Court’s decision in Harvey v. GEICO, where the court concluded that the failure to use due care (in other words, negligence) supported a finding of bad faith.5

HB 837 also establishes two mechanisms for resolving competing claims by multiple claimants to insufficient limits: interpleader and binding arbitration. Prior to enactment of this provision, a scenario where there are multiple claimants and insufficient limits was one of the most dangerous situations an insurance carrier could find itself in from a good faith perspective, as the claimant left without full compensation would often challenge the reasonableness of the carrier’s settlement decisions and seek an extracontractual recovery.

Most importantly, HB 837 provides a 90‑day safe harbor in which an insurer may tender policy limits upon receiving notice and sufficient proof of a third-party claim in order to avoid bad faith exposure. Prior to the enactment of this provision, the plaintiffs’ bar often (incorrectly) claimed that Harvey stood for the proposition that tendering policy limits within nine days of learning of a loss could still be too late under Florida bad faith law. The significance of this particular provision to the reduction of bad faith exposure in Florida cannot be understated.

Strategies to Consider to Avoid Bad Faith Exposure in Light of Recent Developments

In the complex realm of insurance, the importance of building trust and credibility cannot be overstated. As insurance providers, adopting strategies to avoid bad faith claims is not just a legal imperative but a crucial step towards fostering positive relationships with policyholders. Let's explore key strategies that should be employed to avoid bad faith.

Clear written and oral communication – Communicate all settlement demands and offers clearly to the insured. Clearly explain the potential for an excess judgment and the insured’s right to secure personal counsel at their expense.

Documentation – Emphasize the importance of detailed documentation, particularly in cases of obstruction of settlement efforts by the claimant’s counsel as this is now relevant in a bad faith analysis. Thorough file documentation is crucial for effective claims handling.

Training Programs – Knowledge is power, especially in the world of insurance. Regular training sessions on claims handling procedures, coupled with recent case studies, empower adjusters to make informed decisions. Continuous education serves as a guiding principle, ensuring teams remain well-informed and steadfast in ethical best practices.

Prompt evaluations – Leverage the 90‑day safe harbor period under HB 837 and establish standard operating guidelines for updated evaluations at the 60‑day mark. This ensures timely assessments, preventing missed settlement opportunities.

Legal assistance – Work with experienced legal counsel to consider the items above and to navigate potential bad faith scenarios. Stay vigilant as the plaintiff’s bar seeks new avenues to recover revenue lost due to HB 837.

Going Forward

Navigating the intricacies of handling policy limits demands in Florida requires a delicate balance of legal compliance, ethical conduct, and customer-centric practices. Implementing these strategies not only safeguards against bad faith claims, but also builds a reputation grounded in trust, transparency, and fair dealing. Claims adjusters should receive regular training to stay abreast of material developments in the law affecting their legal obligations to their insureds and best practices for avoiding extracontractual exposure.

Our Claims team at Gen Re is ready to work with you as we collectively face the “new frontier” in Florida. Please do not hesitate to reach out to us at any time.

About the Guest Contributor

Christina Roberto, a partner at Tittmann Weix, serves as national counsel for insurer clients, advising on complex coverage issues. She handles numerous high risk and complicated coverage matters across a spectrum of insurance products, including CGL, D&O, E&O, pollution liability, multimedia liability, crime, and cyber policies, including intercarrier disputes and bad faith litigation.

Endnotes

- Florida Defense Lawyers Association, Letter to Chief Justice Carlos Muniz, 23 Mar 2023, https://fingfx.thomsonreuters.com/gfx/legaldocs/akpeqnzjgpr/FDLA%20Letter%20to%20Justice%20Muniz.pdf.

- Statistics and graph provided by Michael A. Rosenberg Esq. of the Roig Lawyers firm.

- William Rabb, “25,000 Lawsuits by Today? Florida Plaintiff Firms Rushing to File Before Tort-Reform Bill Signed into Law,” Insurance Journal, March 23, 2023, https://www.insurancejournal.com/news/southeast/2023/03/23/713579.htm

- FDLA Letter to Chief Justice Carlos Muniz (05224350).docx, March 23, 2023, https://fingfx.thomsonreuters.com/gfx/legaldocs/akpeqnzjgpr/FDLA%20Letter%20to%20Justice%20Muniz.pdf

- 259So. 3d 1, 10 (Fla. 2018).