-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Workers’ Comp Industry – “A Financially Strong System”

30. Mai 2024

Bill Lentz

Region: North America

English

2024 NCCI’s Annual Insights Symposium – Gen Re Summary and Highlights

According to the latest industry analysis provided at NCCI’s Annual Insights Symposium (AIS), Workers’ Compensation results were strong and stable at year end 2023, while continuing to outperform other Property/Casualty lines of business. As continued profitability, strong employment and payroll increases yield a healthy Workers’ Compensation system, the potential for a recession and inflationary pressure on medical costs remain muted. Read on for a summary, along with key takeaways from the symposium.

Industry Results

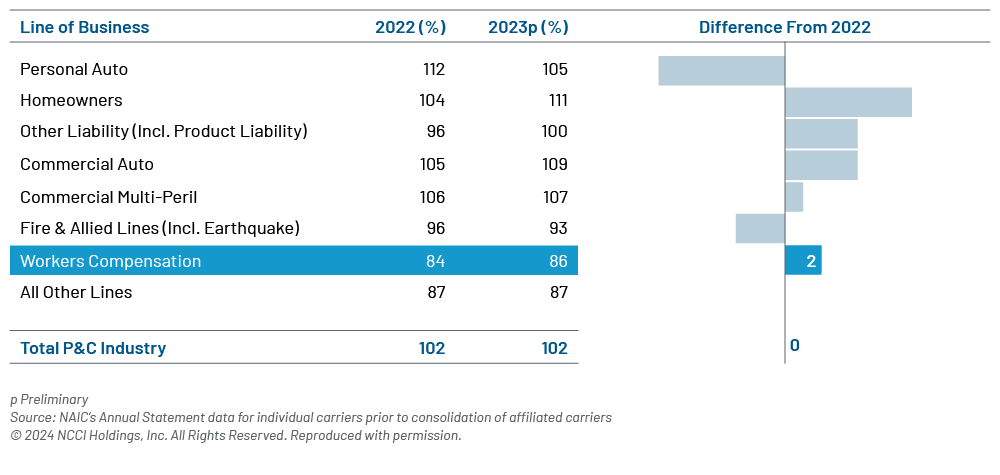

The calendar year 2023 combined ratio for private carriers is 86%. This is the seventh consecutive year of results under 90% and now a full decade of underwriting gains. Workers’ Comp results continue to compare favorably against the total P/C net combined ratio of 102%. Lost-time claim frequency estimates for 2023 is 8% lower than 2022, which is more than double the long-term average change of ‑3.4%. Severity changes in 2023 are moderate for both medical and indemnity. Workers’ Comp pharmacy costs have experienced an annual reduction of 2.5% and now make up approximately 7% of the overall medical paid cost distribution, which is a significant decrease from 17% in 2015.

Net written premium for private carriers in 2023 was $43 billion, which is an increase of 1% from 2022. Rates continue to decline, and written Bureau premium levels are expected to decrease by an average of 9.2% from 2023 to 2024 based on loss cost/rate changes in approved NCCI filings. Payroll increased by 6.2% in 2023, consisting of 2.3% from employment and 3.9% from wages. While wage growth was strong across many sectors, the largest employment gains were in the Leisure & Hospitality and Healthcare sectors.

P&C Industry Net Combined Ratio (Private Carriers)

Economy

According to Stephen Cooper, Executive Director and Senior Economist for NCCI, the U.S. economy is in decent shape overall. Over 2023, real GDP grew by 3.1%. Against fears of a recession and the expected negative impact of interest rate hikes, the economy proved resilient. The first quarter of 2024 is off to a good start as well. As a result, along with favorable development regarding inflation data, consumer sentiment is starting to pick up. However, Mr. Cooper states there is always the potential for external shocks, such as global geopolitical events, which could negatively impact the economy. Thus far, it has remained resilient to recent events.

Labor Market

In 2023, three million new jobs were added to the labor market. Mr. Cooper states that 2024 is presently on track to add a similar amount. While the labor market is growing and the number of jobs currently exceed the amount that existed just prior to the pandemic, they still fall short of the pre-pandemic job growth trend-line. However, labor market churn has reduced significantly. The employee turnover rate and new hire rate have normalized to pre-pandemic levels. Low unemployment and solid hire rates point to a continuing strong labor market.

Regarding the overall U.S. population, the last of the baby boomer generation are nearing their retirement years. Population growth is slowing. By 2030, millennials and Generation Z will represent most of the labor force. As these two generation groups are smaller than those that came before it, the population continues to trend older.

Inflation / Interest Rates

According to Mr. Cooper, inflation slowed in 2023 after reaching a 40‑year high of 9%. Core CPI remains stubborn and includes core goods/services, housing and rents, and home and auto insurance. As of today, general inflation is at approximately 3.5% against the Feds target of 2% to 2.5%.

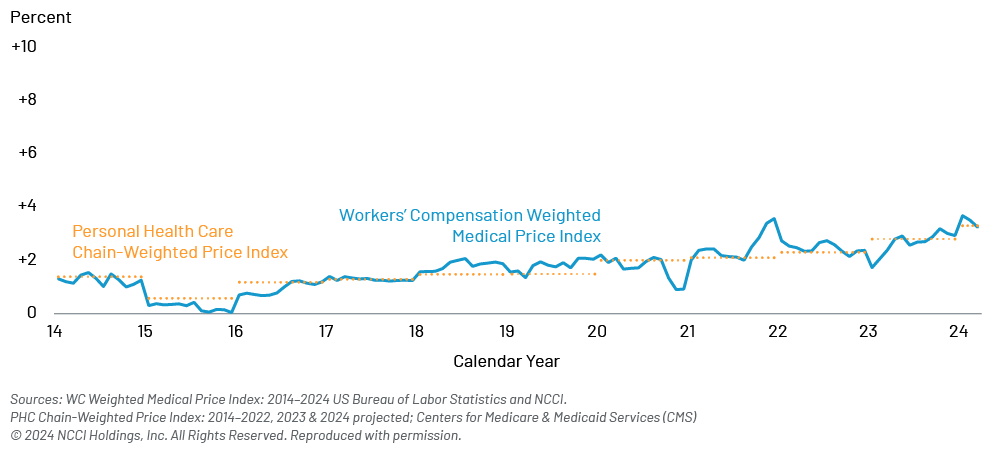

Medical inflation is separate from general inflation and its trend has been much more benign. While reviewing all medical indexes, NCCI also created the Workers’ Compensation Weighted Medical Price Index, which adjusts to specifically Workers’ Comp related medical costs. This index reflects medical inflation growing at a 2%‑3% trend, which is considered moderate. Medical costs that impact Workers’ Comp have both unique price trends and utilization trends for each type of medical service. Physician services has the highest distribution in terms of medical spend but traditionally sees the lowest level of price increases. The categories with the highest price pressure include hospital inpatient/outpatient care, but they represent an overall smaller share of total medical spend distribution.

Interest rates are higher, which has brought back investment income for the Workers’ Comp industry. While a gradual reduction is anticipated, possibly starting in 2024, the economy will dictate how quickly this may occur. It will depend on how both the labor market and inflation continue to evolve. The variability of these factors may result in interest rates remaining elevated for a longer period, which is a positive for investment income.

Workers’ Compensation Weighted Medical Price Index

NCCI State of the Line Report

NCCI’s Chief Actuary, Donna Glenn, provided a detailed review of results, trends, and cost drivers in the Workers’ Comp industry. Here are selected highlights from her presentation:1

- WC Premium – The 2023 net written premium for private carriers increased 1% from 2022 to $43 billion. When including state fund data, the total net written premium was $48 billion.

- WC Net Combined Ratio – The 2023 private carrier calendar year (CY) combined ratio is 86%. At the individual carrier level, nearly 40% of carriers had a net combined ratio below 86%, and two thirds saw an underwriting gain in 2023. The two-point increase from 2022 is the result of an increase in the loss ratio component. The 2023 accident year (AY) combined ratio is 98%, but NCCI believes it will improve by nine points (to 89%) when all claims are settled and closed.

- Investment Results – The preliminary WC investment gain on insurance transactions ratio increased slightly to 9% in 2023. While below the WC long-term average of 11.7%, it is above the P/C industry ratio of 8%.

- Pre‑Tax Operating Gain – 2023 saw a 23‑point pre-tax operating gain (9% investment gain ratio and 14% underwriting gain). This is the seventh straight year with results over 20% and ninth straight year with operating gains greater than the long-term average of 13%.

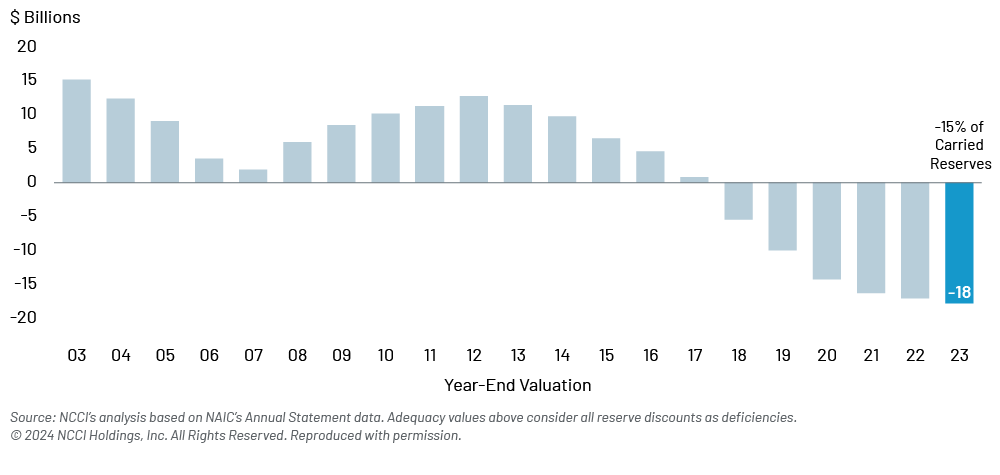

- Reserve Adequacy – NCCI estimates the year-end 2023 WC reserve position for private carriers to have grown to a $18 billion redundancy. A stark contrast to the $12 billion deficiency that existed in 2012, these results reflect a strong financial position.

- Claim Frequency – NCCI estimates WC lost-time claims frequency for AY 2023 is 8% lower than the previous year, which is more than double the long-term average change of ‑3.4%. Per NCCI, approximately 53% of carriers had a frequency change below ‑8% while 29% of carriers had a positive frequency change.

- Indemnity Severity – The average indemnity cost per claim for AY 2023 is estimated to be 5% higher ($27,900) than for AY 2022. The larger-than-average change is mostly driven by increased wages, which have risen significantly in recent years; however, wage growth has outpaced the growth in average indemnity claim severity.

- Medical Severity – NCCI estimates the average medical lost-time claim severity for AY 2023 to be about 2% higher than AY 2022. This increase in severity is driven by a decrease in the volume of the lost-time claims rather than a change in the volume of medical loss dollars.

WC Net Loss and LAE Reserve Adequacy (Private Carriers)

As noted by Bill Donnell, President and CEO of NCCI, in his introductory remarks, lower cost trends in Workers’ Comp are the result of the alignment between carrier and employers regarding safety initiatives, the use of fee schedules, the favorable reduction of opioid prescriptions, statute-based benefits, and that climate change, so far, has not had a significant impact on Workers’ Comp as compared to other lines of business. However, questions remain about the future, including how will frequency develop in the future, what are the next healthcare trends, and how will changes to the economy impact the Workers’ Comp industry?

Workers’ Comp remains healthy and resilient as it continues to stay true to its responsibility of serving injured workers and their families. Gen Re is proud to be there for its clients as they continue to deliver on that promise. We look forward to working together towards your continued success!

Gen Re wishes Bill Donnell all the best as he has announced his planned retirement in early 2025!

Endnote

- Full report is available at NCCI.com. 2023 data is preliminary.