-

Schaden & Unfall

Schaden & Unfall ÜberblickRückversicherungslösungenTrending Topic

Schaden & Unfall

Wir bieten eine umfassende Palette von Rückversicherungslösungen verbunden mit der Expertise eines kompetenten Underwritingteams.

-

Leben & Kranken

Leben & Kranken ÜberblickUnsere AngeboteUnderwritingTraining & Events

Leben & Kranken

Wir bieten eine umfassende Palette von Rückversicherungsprodukten und das Fachwissen unseres qualifizierten Rückversicherungsteams.

-

Unsere Expertise

Unsere Expertise ÜberblickUnsere Expertise

Knowledge Center

Unser globales Expertenteam teilt hier sein Wissen zu aktuellen Themen der Versicherungsbranche.

-

Über uns

Über uns ÜberblickCorporate InformationESG bei der Gen Re

Über uns

Die Gen Re unterstützt Versicherungsunternehmen mit maßgeschneiderten Rückversicherungslösungen in den Bereichen Leben & Kranken und Schaden & Unfall.

- Careers Careers

Beat the Odds With a Healthy Heart – Medically and Financially

Every year, World Heart Day is celebrated on 29 September. World Heart Day1 aims to remind everyone to take care of their cardiovascular health and to raise awareness of and knowledge about how to keep one’s heart healthy. According to the World Heart Federation, cardiovascular disease (CVD) is the number one killer in the world. It has been estimated that 20.5 million people died from CVD in 2021, accounting for close to a third of all deaths.2 Globally, CVD affects different countries with varying severity, recording a larger proportion of deaths in low- or middle-income countries than the higher-income countries.3

Prevention is better than cure. This principle encapsulates the spirit of World Heart Day, as it aims to raise awareness and knowledge among the public. Management of lifestyle and dietary habits is key to maintaining good cardiovascular health. Apart from non-modifiable risk factors such as strong family history or gender, individual choices such as smoking, an unhealthy diet, or a sedentary lifestyle increase one’s risk of having a cardiovascular disease.

Cardiovascular Diseases Risk

Gender

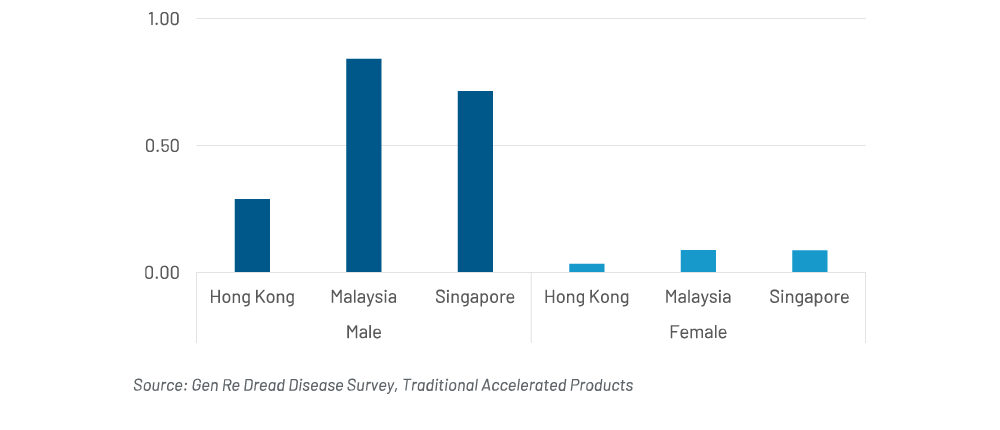

Even among insured lives, which are generally associated with more affluent populations, our Dread Disease Survey results in 2015–2019 show that major Critical Illnesses claims for heart attack and other heart-related diseases for males account for 18% of the claims in Hong Kong, 33% in Malaysia, and 35% in Singapore. The proportions for females are generally lower, with heart-related diseases contributing around 2% of the claims in Hong Kong, and 6% in both Malaysia and Singapore.

Looking at the heart attack incidence rate specifically, we can see that Hong Kong has the lowest heart attack age standardised incidence rate (ASIR) across the three markets and the ASIR in Malaysia is only slightly higher than that of Singapore. Cross-gender comparison also shows that males are, in general, more likely to suffer from heart attack, with the ASIR for males being approximately eight times higher than for females in each of the markets. This difference has been well studied, with several studies pointing partially towards oestrogen hormones produced during menstrual cycles as having protective properties against coronary artery diseases.4

ASIR of Heart Attack and Coronary Artery Bypass Graft (CABG)

Smoking

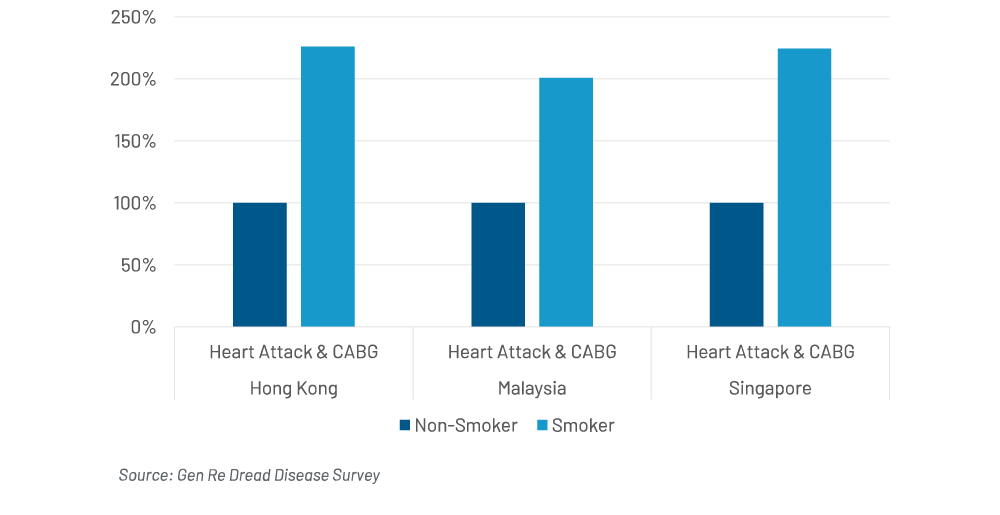

Tobacco use has significant negative impacts on one’s cardiovascular health. Multiple studies5 over the years have shown that smoking significantly increased the risk of heart attack. The risk had a dose-response relationship, increasing linearly with an increase in the number of cigarettes smoked per day and duration of use.6 In addition, women using tobacco lose the gender protection against heart disease noted among women younger than age 50 years.7

Such observation can also be made of insured lives in all three markets in Gen Re’s Dread Disease survey, showing a relative risk of between 2–2.5 times for smokers when compared to a non-smoker. Engaging with our policyholders to help them quit or reduce smoking would be a win-win for all concerned.

Relative Risk of Heart Attack & CABG Between Smoker and Non‑smoker

Diet

In addition to limiting or ceasing use of tobacco, a healthy diet is an important aspect in managing one’s cardiovascular health risk. A diet full of fruits and vegetables, whole grains, nuts, fish, and poultry, together with reduced consumption of damaging foods such as red and processed meats and refined carbohydrates, could reduce one’s risk of heart disease by as much as 31%.8 Educating policyholders on the benefits of a healthy diet will go a long way in encouraging them to maintain a balanced diet.

Exercise

In August 2023, the world’s largest study9 published results showing that the more you walk, the lower your risk of death, even if you walk fewer than 5,000 steps per day. The analysis of 226,889 people from 17 different studies around the world has shown that the risk of dying from any cause or from cardiovascular disease decreases significantly with every 500 to 1000 extra steps you walk each day. An increase of 1000 steps a day was associated with a 15% reduction10 in the risk of dying from any cause, and an increase of as few as 500 steps a day was associated with a 7% reduction in dying from cardiovascular disease.

Financial Protection and Cardiovascular Disease – Are You Sufficiently Covered?

In addition to prevention, another important aspect to consider is protection against the financial burden for those who have suffered from CVD. These financial hardships could come from having to pay for the medical bills and from loss of income during treatment. This was the reason why Dr Marius Barnard, a cardiac surgeon who was a non-insurance practitioner, founded Dread Disease Insurance together with Crusader Life and with the support of Cologne Re (now Gen Re) in 1983.

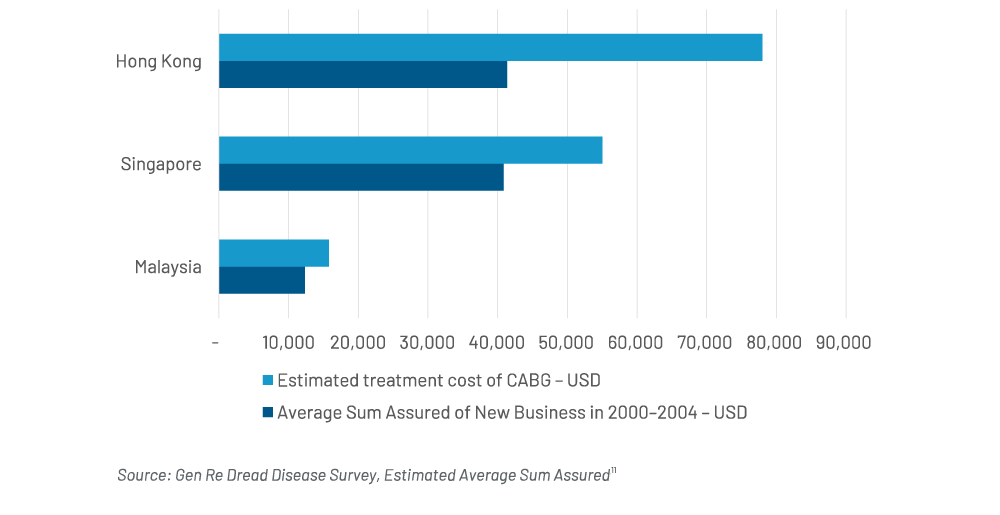

Rapid scientific and technological advancement has tremendously increased the cost of managing CVDs. In addition, sustainability in healthcare financing across Asia have been under question in recent years with medical inflation being much higher than the general inflation. Therefore, at an individual level, having sufficient critical illness/medical insurance is the way to remove uncertainty from the burden of future healthcare costs.

Underinsurance and insurance protection gap is often a hidden threat. From Gen Re’s Dread Disease Survey, it has been observed that the median age at claim for CVD is in the early 50s, but the average issued age of policies are typically in the late 20s. The impact of inflation would be huge in this approximately 20 years gap between the point of policy issuance to point of claim.

Following this logic, the figure below shows the estimated cost of a coronary artery bypass surgery in USD across different markets in a private hospital today, comparing it with the average sum assured of CI insurance issued approximately 20 years ago between 2000–2004. Clearly, the coverage provided by CI insurance purchased then is insufficient to pay for the medical treatment today.

Similarly, if we extrapolate this information, it is highly likely that the insurance coverage amounts bought today will also be insufficient to cover medical costs in the future. Therefore, with the rapid rise in medical inflation, one needs to re‑evaluate the adequacy of their Critical Illness insurance protection on a regular basis.

Comparison of Treatment Cost of CABG Today vs. Average Sum Assured When CI Was Originally Purchased (20 Years Back)

Cardiovascular Disease Coverage in Critical Illness Insurance

Heart Attack and CABG have traditionally been covered by Critical Illness insurance, with today’s product covering even minor cardiovascular-related conditions such as angioplasty, minimally invasive CABG, insertion of pacemakers etc. However, even with the large number of cardiovascular-related diseases covered, the critical illness insurance might not be comprehensive enough.

Gen Re has constantly strived to innovate on the product front. The System and Organ Function Insurance (SOFI) concept was introduced to the market with the aim to provide more comprehensive coverage and futureproofing of diagnosis by focusing on outcome. For instance, claims will be paid out on all open-chest surgery rather than only open-chest surgery for defined conditions. In addition, claims are also payable if one meets the severity of heart impairment based on the ejection fraction of the heart, thereby futureproofing against diagnosis.

Happy World Heart Day!

As we celebrate World Heart Day, it is important to remember that the insurance industry has a role to play.

Awareness and knowledge of CVD does not only happen on 29 September. There are already several insurers who have been actively encouraging their policyholders to lead healthier lifestyles on an ongoing basis by incentivising or encouraging behaviours such as:

- Reducing/quitting smoking

- Engaging in exercise-related activity

- Encouraging healthy diet with reduced sugar and processed food intake

Even though “Prevention is better than cure”, one can never be sure that CVD will not happen to themselves. Therefore, should such as unfortunate event strike, it is important to have sufficient financial protection.

Finally, innovation in insurance products that protect one’s cardiovascular health continues to evolve. We at Gen Re support this initiative and welcome insurers who are keen to take an active role to contact their respective local representative.

- World Heart Federation, https://world-heart-federation.org/world-heart-day/about-whd/world-heart-day-2023/

- World Heart Federation, https://world-heart-federation.org/wp-content/uploads/World-Heart-Report-2023.pdf

- WHO, https://www.who.int/news-room/fact-sheets/detail/cardiovascular-diseases-(cvds)

- National Library of Medicine, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5655818/, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC59620/#:~:text=Observational%20studies%20have%20almost%20universally,with%20established%20CHD%20%5B6%5D

- National Library of Medicine, https://www.ncbi.nlm.nih.gov/books/NBK525170/

- Yusuf S., Hawken S., Ounpuu S., Dans T., Avezum A., and others. 2004. “Effect of Potentially Modifiable Risk Factors Associated with Myocardial Infarction in 52 Countries (the INTERHEART Study): Case-Control Study.” The Lancet 364 (9438): 937‑52

- Barua R. S., Ambrose J. A., Eales-Reynolds L. J., DeVoe M. C., Zervas J. G., Saha D. C. 2001. “Dysfunctional Endothelial Nitric Oxide Biosynthesis in Healthy Smokers with Impaired Endothelium-Dependent Vasodilatation.” Circulation 104 (16): 1905‑10. [PubMed]

- Harvard College, https://www.hsph.harvard.edu/nutritionsource/disease-prevention/cardiovascular-disease/preventing-cvd/#:~:text=The%20best%20diet%20for%20preventing,sodium%2C%20and%20foods%20with%20trans

- European Society of Cardiology, https://academic.oup.com/eurjpc/advance-article/doi/10.1093/eurjpc/zwad229/7226309

- European Society of Cardiology, https://www.escardio.org/The-ESC/Press-Office/Press-releases/World-s-largest-study-shows-the-more-you-walk-the-lower-your-risk-of-death-even-if-you-walk-fewer-than-5-000-steps#:~:text=The%20study%2C%20published%20in%20the,blood%20vessels%20(cardiovascula

- Estimated Cost of Bypass

Hong Kong – HSBC Life, https://www.hsbc.com.hk/content/dam/hsbc/hk/docs/insurance/booklets/understanding-your-medical-protection-needs.pdf

Singapore – ValueChampion, https://www.valuechampion.sg/average-cost-cardiovascular-disease-treatment-singapore

Malaysia – Gleneagles Hospitals, https://gleneagles.com.my/packages-promotions/coronary-artery-bypass-grafting-(cabg)-package

Malaysia – Ringgit Plus, https://ringgitplus.com/en/blog/sponsored/how-much-do-the-most-common-critical-illnesses-in-malaysia-cost.html

Endnotes last accessed on 27.09.2023